Table of Content

The FHA can only insure an amount up to this limit. A high-end home, with the standard FHA down payment of 3.5 percent, might have a loan amount that exceeds the limit. For example, San Francisco County, which has the highest possible loan limit because it is considered a high-cost area, has a limit of $729,750 for a single-family home. A home that costs $800,000, with a minimum down payment contribution by the borrower of $28,000, does not qualify for FHA.

Use our home value estimator to estimate the current value of your home. See our current refinance ratesand compare refinance options. Take your monthly debt payments, including your mortgage payment, property taxes, insurance and HOA fees, and divide them by your income.

FHA 203k loan: Buy & repair a home with one loan

These properties are considered unique, have few “comparables” that can be used to establish a fair market value, and are generally problematic for the FHA lender in general. That’s why you won’t have the option to build such houses using an FHA loan but you WILL have the option to build more traditional type housing. Moss by itself isn’t necessarily something that an appraiser will call. If an appraiser calls a problem with anything, your lender is probably going to require that the issue be corrected as a condition of closing your loan.

As a result, homes must meet criteria developed by HUD, which oversees the FHA's programs. In general, conventional loans simply tend to close faster. Less paperwork and fewer stipulations allow these mortgages to be processed faster, and many sellers find this an attractive bonus. A home in good repair with typical maintenance generally is no problem ...

What if a Property Doesn't Meet Criteria for an FHA Loan?

There are several reasons a home might be rejected for an FHA loan. FHA loans are designed for people who may not qualify for a traditional home loan due credit score or down payment requirements. Lower interest rates can more than offset the increased cost of Mortgage Insurance Premiums.

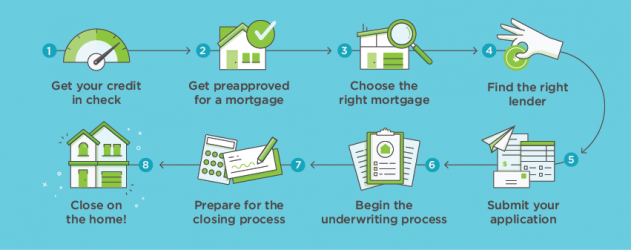

Getting an FHA loan can be easy when you understand how the process works. Though it can seem difficult to understand all the details, our Home Lending Advisors are here to guide you through each step. FHANewsBlog.com is privately funded and is not a government agency. Loan Limits – FHA loans must not exceed the Federal Loan Limits in your area.

How do you win an FHA bid?

These complexes meet HUD standards for financial stability and hazard and liability insurance. Manufactured homes are also held to specific standards. For instance, the home must be permanently affixed to its foundation, be taxed as real estate, and have a construction date on or before June 15, 1976. If a home doesn't qualify for FHA-insured financing, it might qualify for conventional financing. Conventional loans have appraisal and property condition criteria that might be less stringent than the FHA's.

The FHA has put minimum property standard requirements in place to protect the lender should the borrower default on the loan. If a borrower stops making mortgage payments, the lender will eventually foreclose and take possession of the house as a way to sell the house and reclaim money owed on the loan. Closing costs for FHA loans are about the same as they are for conventional loans, with a couple exceptions.

He or she can often spot issues that will be problematic and can direct you to further resources as needed. I’m here to help, of course, especially if you’re buying in the “south of Seattle” area of Washington. However, I’ve yet to have an appraiser ask for permit information for ADUs or in-law spaces that are part of a home.

Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The entire FHA loan process takes between 30 days and 60 days, from application to closing. Meanwhile, an FHA loan is good for young and first-time homeowners.

Lowering your scores ahead of a home loan is to be avoided at all costs. But this isn’t the only reason to avoid a car loan ahead of or during your home loan application process. If you try to apply for both at once, you will find that any hard credit inquiries will lower your credit score. Residency Requirements– The homebuyer must live in the home as their primary residence. This prevents FHA loans from being used for real estate investing. Mortgage insurance protects the lender if you cannot pay your mortgage down the road.

Either way, someone has to fix the issues or there will be no FHA loan. While there are many claims out there from companies offering non traditional loans, some of them are better choices for you than others, depending on your situation. However, keep in mind that not every home is FHA-approved. The first thing I'll explain to an FHA buyer is the property needs to pass safety and pretty much all you mentioned.

It's the home that's been neglected that can so often be problematic--those homes may need a Rehab loan FHA 203 where the cost of home repair is included in the home loan. Has no health or safety issues that could compromise your ability to repay your mortgage. During inspection, water leaked from upstairs bathtub through downstairs bathroom ceiling. Old water stain visible in ceilling about 12 inches in diameter. The water bubble that popped out from the ceiling is about a 1 inch diameter. The house is a relocation property, sold “As is” with no option period, but does have third party financing contingency.

Statistically speaking, people with debts exceeding 43 percent often have trouble making their monthly payments. The highest ratio you can have and still be able to obtain a qualified mortgage is also 43 percent. A small, healthy amount of debt is good for a credit score if the debt is paid on time every month.

No comments:

Post a Comment